Ethereum holds regular above $3,300, as crypto merchants gear up for President-elect Donald Trump’s inauguration. Derivatives merchants are bullish on Ethereum, and open curiosity in Ether’s derivatives contracts crossed $30 billion as of Friday.

Ethereum’s giant pockets buyers proceed accumulating the token regardless of its lacklustre value efficiency in 2024. The altcoin enjoys a excessive correlation with Bitcoin, and the current market movers are conducive to good points in Ether.

Ethereum sees huge bets from derivatives merchants

Ethereum derivatives information on Coinglass exhibits an almost 47% enhance in choices commerce quantity previously 24 hours, as derivatives open curiosity hovers round $30 billion. Choices quantity crossed $1 billion in a 24-hour timeframe.

The lengthy/brief ratio, used to establish whether or not derivatives merchants are bullish or bearish on a token, is bigger than one on Binance and OKX. Derivatives merchants are bullish on a rise in Ethereum value.

The chart beneath exhibits the rise in open curiosity in Ethereum because the newest US Presidential election. Open curiosity is beneath its peak of $31.99 billion, noticed on January 7, 2025.

Ethereum on-chain evaluation

Derivatives merchants’ outlook is taken into account a measure of what merchants can count on in spot markets. When mixed with bullish on-chain metrics, derivatives merchants’ outlook helps a thesis of good points in Ethereum value.

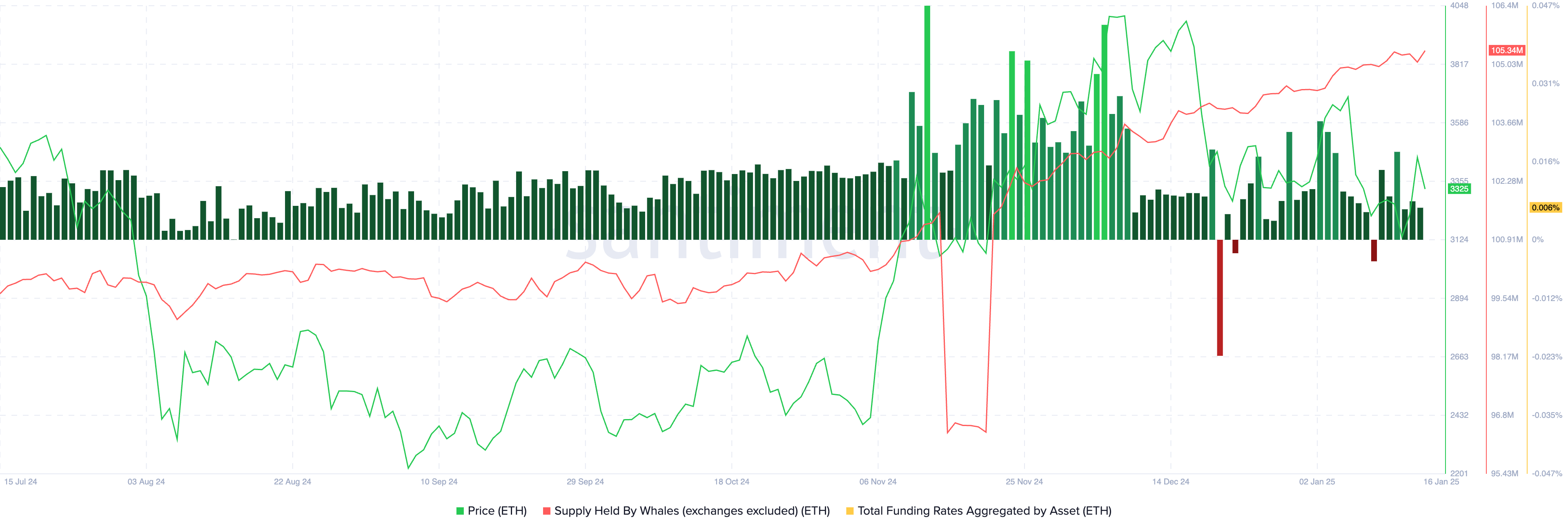

Santiment information exhibits that Ether token provide held by giant pockets buyers has climbed steadily, which means whilst ETH value suffered a decline, merchants continued accumulating. It is a optimistic signal for Ethereum.

The entire funding fee aggregated by Ethereum is usually optimistic all through January 2025. This represents optimism and hope for value acquire amongst merchants.

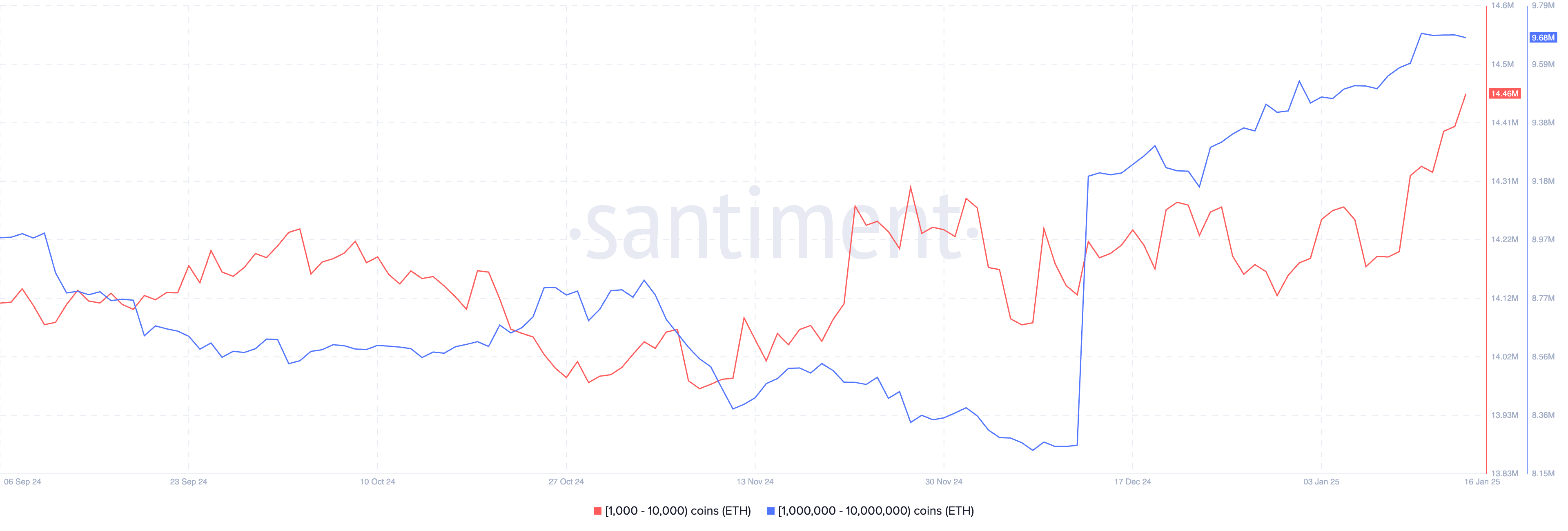

Ethereum held by merchants with 1,000 to 10,000 ETH of their wallets elevated previously week. Equally, holders with 1 million to 10 million Ether added to their ETH holdings between the final two weeks of 2024 and January 17, 2025.

Ethereum market movers

Farside Buyers information exhibits that institutional capital influx to Ether almost doubled on Thursday. ETH Spot ETFs recorded $166.6 million in inflows on January 16, after 59.7 million the day earlier than.

Usually, rising institutional curiosity is bullish for Ether.

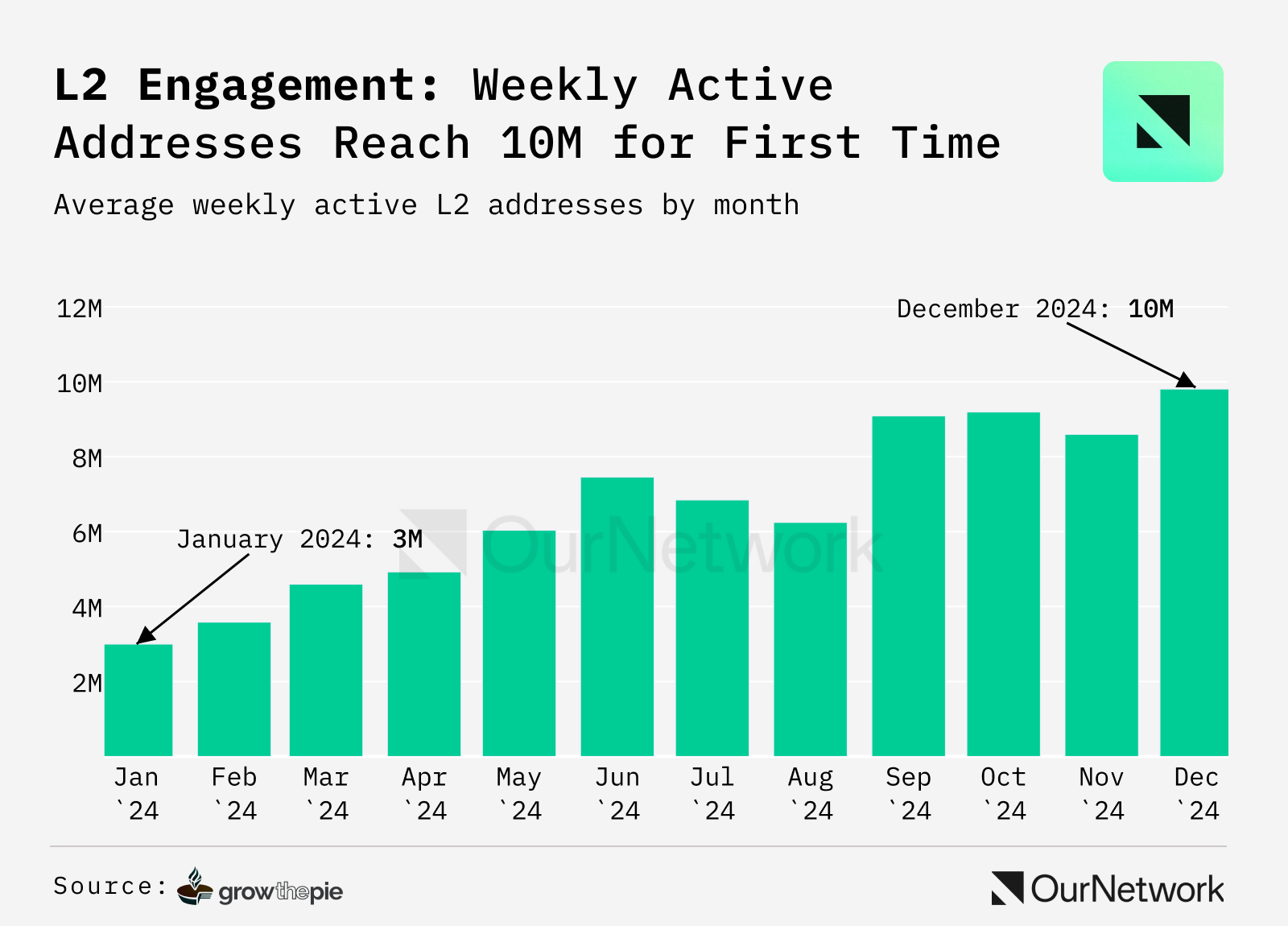

One other key market mover is the rising exercise on the chain from Layer 2 protocols. Information from GrowThePie exhibits that Ethereum Layer 2 chains have skilled speedy development in lively addresses, rising by over 300% in a 12 months and surpassing 10 million weekly. Energetic wallets on a number of Layer 2s are comparatively low, at lower than 5%.

Rising Layer 2 adoption and utility contribute to income for the underlying chain, supporting a thesis of development for Ether.

Technical evaluation and ETH value forecast

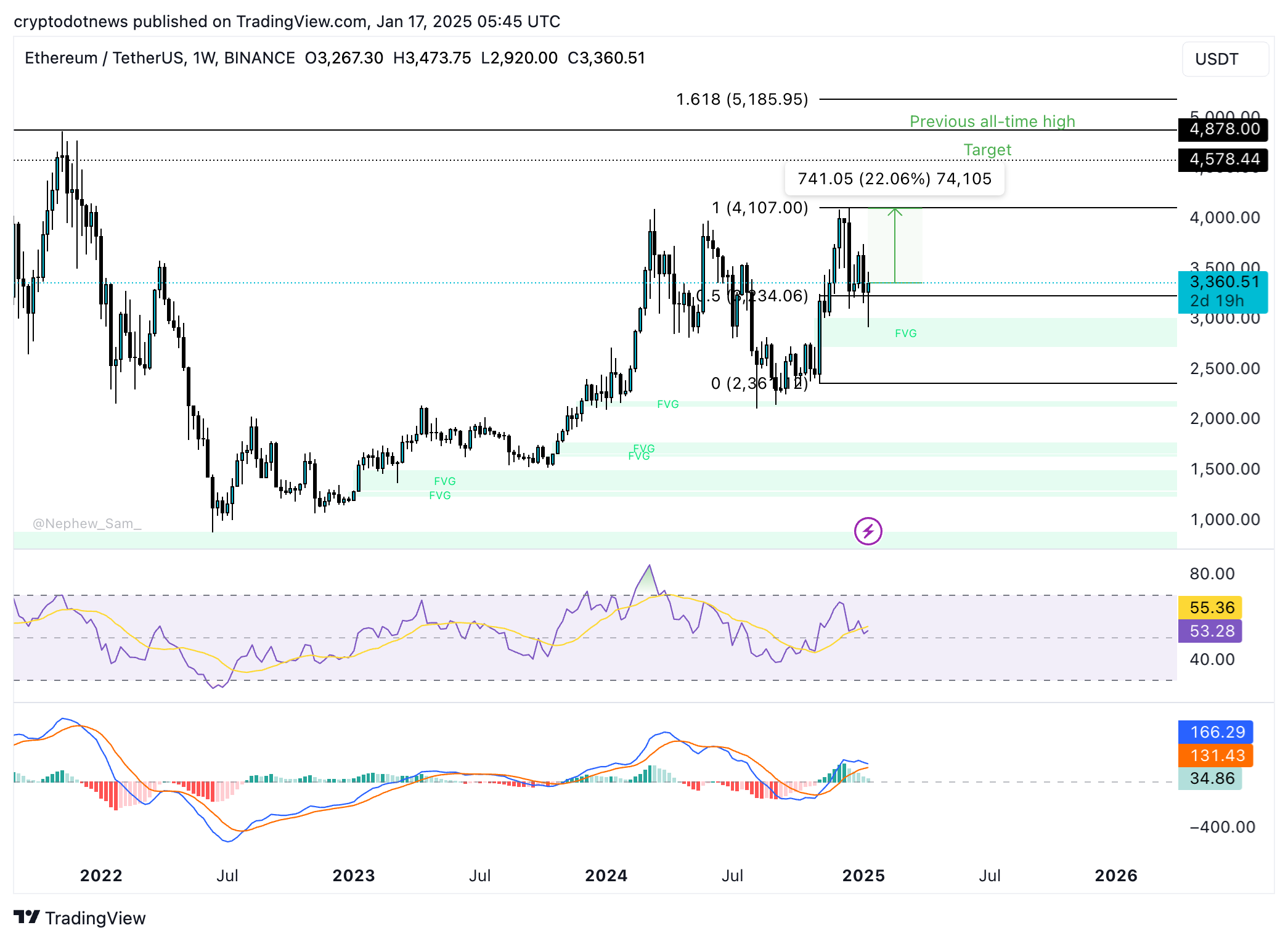

The ETH/USDT weekly value chart exhibits Ether hovering across the $3,360 stage early on Friday. The altcoin is 22% beneath its 2024 peak of $4,107. Two technical indicators, the Relative power index and the shifting common convergence divergence, assist a bullish thesis for Ethereum.

RSI is sloping upward and reads 53, MACD flashes consecutive inexperienced histogram bars, supporting a bullish thesis for Ethereum on the weekly timeframe.

If Ethereum ends its consolidation and breaks above the December 2024 peak, the altcoin may goal the $4,578 stage and rally in the direction of its earlier all-time excessive at $4,878, as seen within the ETH/USDT weekly chart beneath.

Vitalik Buterin’s tackle Ethereum Layer 2 and the way forward for Ether

Buterin just lately commented on Sony Block Answer Labs’ Soneium. Buterin stated the challenge demonstrates how Ethereum Layer 2 is “nice for companies and customers” in a tweet on X.

Buterin believes that the creation of a free market on the Layer 2 stage makes it extra accessible and helpful for companies and customers, supporting the expansion of the Ethereum ecosystem. The concept is to think about Layer 2 rollups as enterprises in-built cities inside the “Ethereum mainnet” state.

The controversy surrounding Soneium was the steps taken to safeguard mental property by inserting restrictions on some contracts inside the protocol. Whereas it might appear as if meme coin merchants have been minimize off, customers may proceed transactions on the Ethereum mainnet with a delay of some hours.

Disclosure: This text doesn’t symbolize funding recommendation. The content material and supplies featured on this web page are for academic functions solely.