The Senate hopes to push by means of a Bitcoin reserve invoice within the first 100 days of Trump’s presidency whereas the Republicans seek the advice of on crypto coverage.

American Senator Cynthia Lummis expressed optimism that plans to create a strategic Bitcoin (BTC) reserve might be applied quickly after Donald Trump‘s inauguration.

“I imagine we will get this completed with bipartisan assist within the first 100 days if now we have the assist of the folks. It’s a sport changer for the solvency of our nation. Let’s put America on sound monetary footing and cross the Bitcoin Act!”

Senator Cynthia Lummis

Lummis’s submit responded to David Bailey, BTC Inc. CEO, who has been actively advising Trump on cryptocurrency coverage. Bailey had beforehand advised that such a reserve could possibly be created shortly underneath the brand new administration.

“The Bitcoin and Crypto trade’s coverage wishlist is lengthy and urgent… however the Strategic Bitcoin Reserve is the #1 most pressing and transformational coverage on President Trump’s agenda. The downstream results change every part. We should get it completed within the first 100 days.”

David Bailey, BTC Inc. CEO

Bailey additionally floated the thought of utilizing Bitcoin extra extensively in authorities applications. He advised that if Robert F. Kennedy Jr. have been appointed Secretary of Well being and Human Providers and assumed accountability for managing the Social Safety program, there can be a dialogue about paying 5-10% of Social Safety funds in Bitcoin, saved in a strategic reserve.

What is understood concerning the Bitcoin reserve challenge?

Trump introduced the creation of a Bitcoin reserve within the U.S. in July 2024 throughout a speech at an occasion supporting his election marketing campaign. Just a few days earlier than the politician’s announcement, media stories appeared that Senator Cynthia Lummis was getting ready a Bitcoin reserve invoice known as the BITCOIN Act of 2024.

The act proposes making a community of decentralized vaults nationwide to securely retailer Bitcoin reserves. The U.S. Treasury Division is meant to have 200,000 BTC yearly for 5 years, and the U.S. reserves would finally quantity to 1 million BTC. It’s also assumed that Bitcoin reserves might be saved for no less than 20 years.

The cryptocurrency might be bought on the expense of different belongings on the authorities’ disposal, comparable to gold certificates. Lummis proposes to cowl the prices of buying cryptocurrency by revaluing it.

As well as, the proposal plans to implement a reserve verification system to confirm the supply of funds and consolidate all present BTC which can be at present within the possession of the U.S. authorities into a brand new reserve.

Bitcoin reserves to make the U.S. new crypto haven

Analysts at CoinShares write that implementing the plan to create strategic reserves in BTC can generate vital institutional and authorities curiosity in Bitcoin. In accordance with their forecasts, this may doubtlessly speed up its progress and lift its worth to new heights.

Basically, many members within the crypto group anticipate that the U.S. guess on Bitcoin can considerably enhance the cryptocurrency’s funding attractiveness. For instance, Anthony Pompliano, the founding father of Pomp Investments, is assured that the initiative will trigger the market to expertise FOMO.

Lummis’ proposal implies that the tempo of Bitcoin purchases might outpace the price of BTC mining. On this case, a cryptocurrency deficit will kind out there, which might additionally assist the expansion of its charge.

Trump’s rally is in full swing. Or only a rally?

Basically, Lummis’ phrases are confirmed primarily based on the dynamics of Bitcoin and the whole crypto market for the reason that U.S. elections. Over the previous week, Bitcoin has repeatedly up to date historic highs.

The whole capitalization of the whole crypto market has grown by 25% in per week and exceeded $3 trillion. On the identical time, the worth of Bitcoin has elevated by 23.8% in 7 days, a number of instances updating the all-time excessive and reaching $93,000.

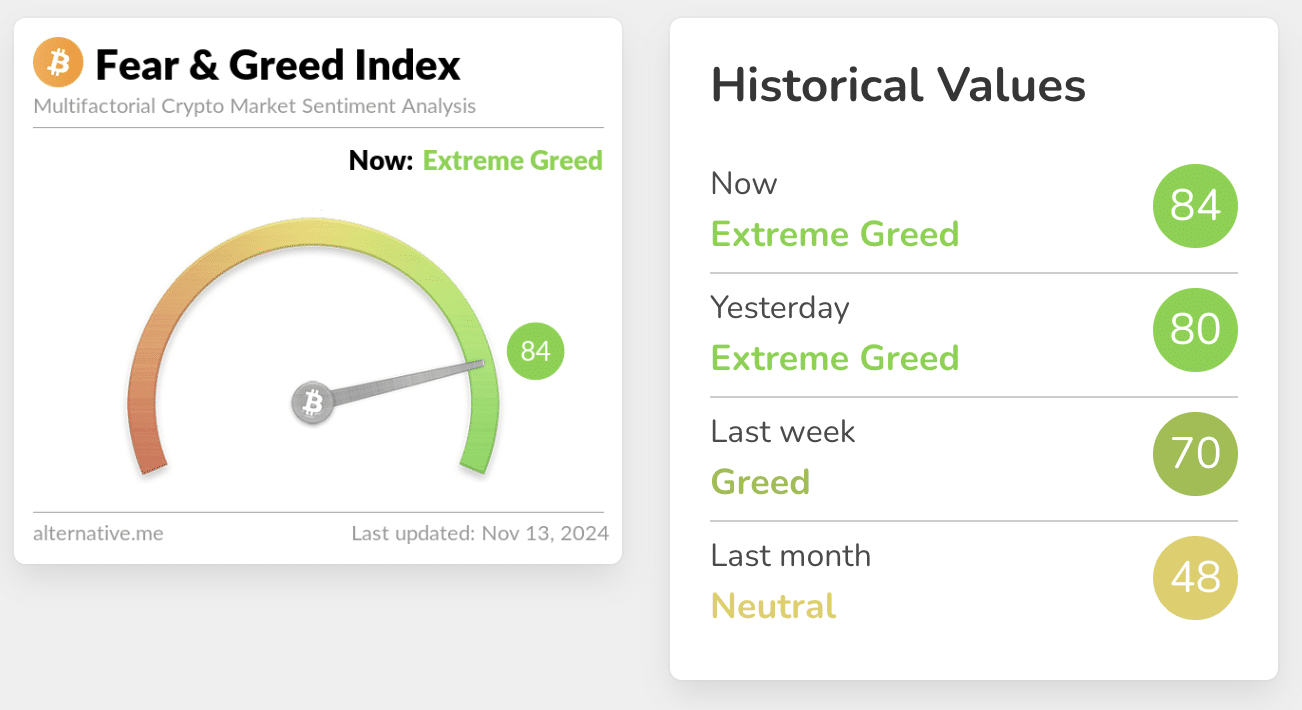

The crypto market’s index of worry and greed has grown by as a lot as 14 factors in per week—from 70 factors to 84 out of 100- indicating the market’s excessive greed.

Nevertheless, some consultants doubted that Trump’s victory was the one progress driver of the crypto market.

Thus, the co-founder of Onramp Bitcoin, Jesse Myers, famous that such crypto market dynamics are routine and predictable after the Bitcoin halving in April. Throughout this time, a scarcity of cash has arisen available on the market, due to this fact the worth is rising underneath stress from demand. This triggers a series response that ought to result in one other bubble.

Myers reminded that the identical state of affairs occurred after every earlier Bitcoin halving, so it is sensible to anticipate one thing comparable this time. The change of energy within the U.S. to 1 doubtlessly extra pleasant to cryptocurrencies solely acted as a catalyst.