Be a part of Our Telegram channel to remain updated on breaking information protection

The cryptocurrency market continues evolving, presenting buyers with alternatives and dangers. With latest value actions and technological developments, digital property equivalent to Litecoin, Mantle, and Decentraland are gaining consideration within the crypto market.

Current market shifts have sparked renewed curiosity in particular tasks, every with distinct use instances and community exercise. This evaluate examines a few of the greatest cryptocurrencies to put money into proper now based mostly on market tendencies and challenge fundamentals.

Greatest Cryptocurrencies to Spend money on Proper Now

Solaxy has secured over $16 million in its ongoing presale, highlighting robust investor curiosity in blockchain scalability options. Decentraland’s value has reached $0.4457, marking a 4.82% improve over the previous 24 hours. In the meantime, BGB trades nicely above its 200-day easy transferring common (SMA), at 1,372% larger than the $0.458 threshold.

1. Litecoin (LTC)

Litecoin is designed for quick and low-cost transactions utilizing blockchain expertise. It shares similarities with Bitcoin however has key variations, equivalent to a unique hashing algorithm, a better whole provide, and quicker block instances. These adjustments purpose to make transactions faster and extra environment friendly.

At present, Litecoin is priced at $113.40, exhibiting a 1.15% decline over the previous 24 hours. Regardless of this short-term dip, market sentiment stays optimistic. The Worry & Greed Index, which measures market feelings, stands at 72, indicating greed.

Litecoin is buying and selling nicely above its 200-day easy transferring common (SMA), a long-term development indicator. It’s 25.30% larger than the SMA worth of $90.58. Over the previous month, Litecoin closed within the inexperienced for 18 out of 30 days, suggesting regular momentum. Liquidity is excessive, that means consumers and sellers can commerce with out important value fluctuations.

The 14-day Relative Power Index (RSI), a measure of whether or not an asset is overbought or oversold, is at present at 44.72. This means impartial circumstances, suggesting that Litecoin might proceed buying and selling sideways.

Whereas Litecoin stays a broadly used cryptocurrency, value actions rely on total market tendencies, investor sentiment, and adoption. Its place above key technical ranges suggests stability, however short-term fluctuations stay doable.

2. Bitget Token (BGB)

Bitget Token (BGB) is the native token for the Bitget trade and its decentralized pockets ecosystem. It features as a utility token, permitting customers to commerce, pay transaction charges, and entry platform advantages.

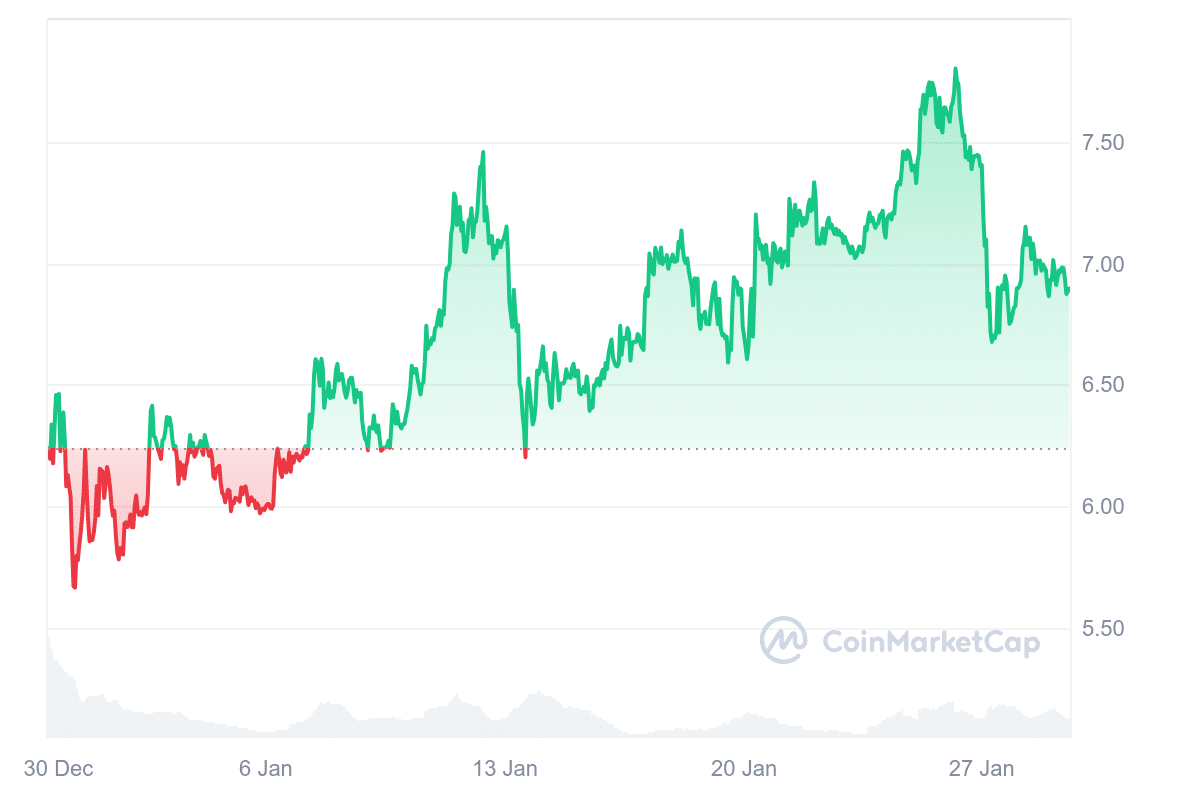

At present, BGB is exchanging fingers at $6.75, with a 24-hour buying and selling quantity of $699.31 million and a market cap of $8.10 billion. Over the previous day, the token’s value dropped by 3.58%, but it surely has gained 8.25% within the final 30 days. Market sentiment stays impartial, whereas the Worry & Greed Index signifies 72, signaling greed available in the market.

Moreover, BGB trades considerably above its 200-day easy transferring common (SMA), standing at 1,372.39% larger than the $0.458 degree. This means a robust long-term uptrend. The token has proven optimistic efficiency in 17 of the final 30 days, indicating secure value motion. Its liquidity stays excessive relative to its market cap, which will help facilitate clean buying and selling.

Fantasy: On-chain buying and selling is all the time costly resulting from excessive gasoline charges. ⛽️

Truth: #BitgetSeed eliminates this barrier by enabling seamless transactions, utilizing $USDT because the gasoline token—making on-chain buying and selling extra inexpensive and hassle-free. 💡 pic.twitter.com/CXmz8OVHih

— Bitget (@bitgetglobal) January 29, 2025

The 14-day Relative Power Index (RSI) sits at 37.70, reflecting impartial circumstances. This metric helps assess whether or not an asset is overbought or oversold. With a adverse yearly inflation price of -14.29%, BGB exhibits indicators of deflationary strain, that means its provide might lower.

Brief-term projections estimate a modest 0.95% improve, protecting the worth secure round $6.75 in February. Whereas BGB has demonstrated resilience, its future efficiency will rely on broader market circumstances and platform developments.

3. Mantle (MNT)

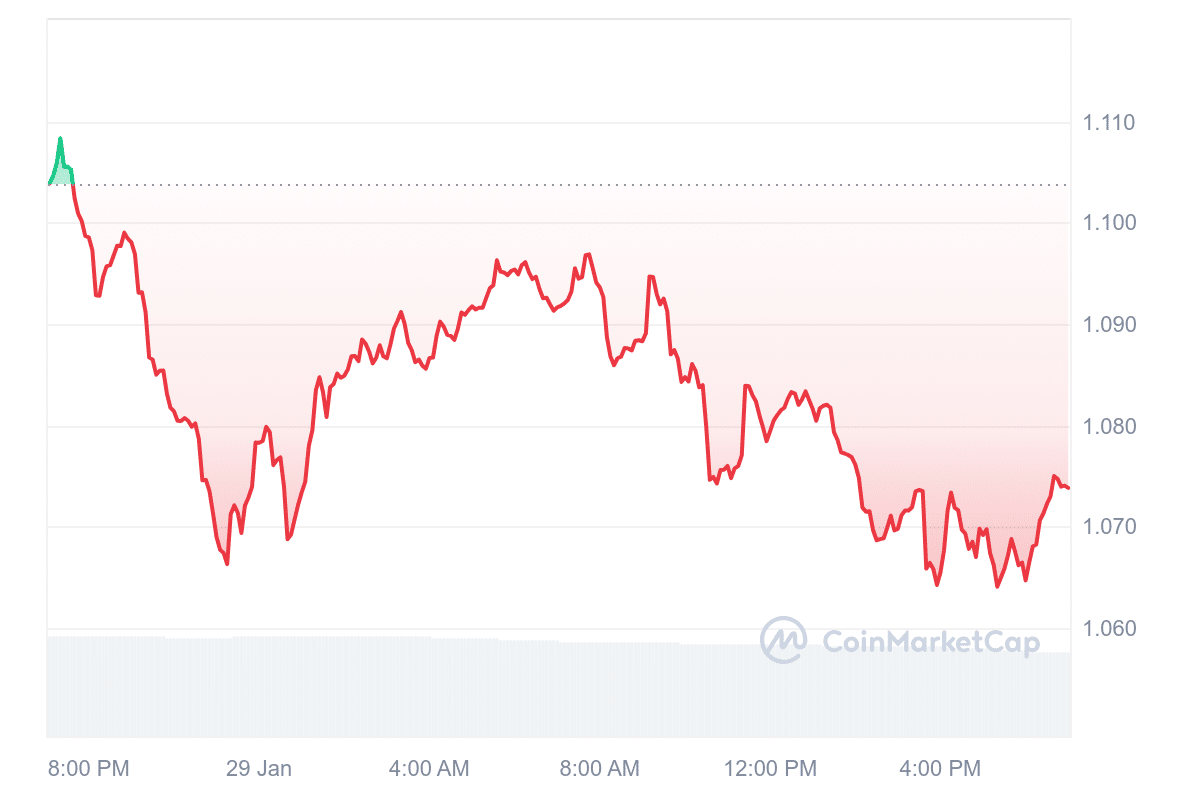

Mantle (MNT) is buying and selling at $1.07, reflecting a 3.05% drop up to now 24 hours. Regardless of this short-term decline, MNT has gained 104% over the past yr. Its market capitalization is roughly $3.6 billion, inserting it because the thirty eighth largest cryptocurrency.

The community has centered on increasing its ecosystem, with plans to introduce six main merchandise in 2025. These embody mETH, a liquid staking resolution, and Ignition FBC, which helps early-stage blockchain tasks.

Builders are additionally engaged on an Enhanced Index Fund, a blockchain-based banking platform, and MantleX, an AI-driven challenge. These updates recommend bettering Mantle’s utility and attracting extra customers.

Current information exhibits a rise in community exercise. Energetic addresses have risen by 50% inside per week, whereas new tackle creation is up by 16%. There has additionally been a noticeable uptick in MNT withdrawals from exchanges, which might point out rising long-term curiosity within the token.

Mantle Community is constructing the liquidity chain of the long run.

Prepared to mix the transformative energy of blockchain with deep liquidity, sustainable yield choices and enriched person expertise 👇

1. Our new technical roadmap is centered round two important upgrades slated… pic.twitter.com/miNRbKoBod

— Mantle (@Mantle_Official) January 28, 2025

Mantle continues to boost its infrastructure, specializing in liquidity options and zero-knowledge (ZK) roll-up expertise. These developments purpose to enhance transaction effectivity and safety, significantly for high-value asset transfers.

The community’s progress displays elevated adoption and continued innovation. Whereas value fluctuations are frequent within the crypto market, Mantle’s ongoing tasks and rising engagement recommend it’s working to determine a stronger presence within the sector.

4. Solaxy (SOLX)

Solaxy (SOLX) is a brand new blockchain challenge aiming to boost the Solana community by introducing a Layer-2 scaling resolution. The challenge has raised over $16 million in its ongoing presale, reflecting investor curiosity in blockchain scalability. Solaxy is designed to handle congestion points on Solana, providing a modular infrastructure that permits builders to construct decentralized purposes (dApps) requiring high-speed efficiency.

This might profit decentralized finance (DeFi) platforms, NFTs, and blockchain gaming. At present, Solaxy’s presale value is $0.00162 per SOLX. The challenge promotes its capacity to deal with excessive transaction volumes effectively, making it related for property equivalent to meme cash that depend on quick transactions.

Moreover, Solaxy goals to stop community slowdowns by offloading exercise from the principle Solana chain. Solaxy additionally incorporates a staking program with a dynamic annual share yield (APY) of as much as 243%. Staking permits customers to earn passive revenue whereas supporting the community. To date, 4.7 billion SOLX tokens have been staked, suggesting early confidence from buyers.

As a Layer-2 resolution, Solaxy seeks to enhance blockchain effectivity, however its precise efficiency will rely on adoption and execution. Whereas the presale has attracted important curiosity, the challenge’s success will hinge on its capacity to combine successfully with Solana and supply tangible advantages to customers and builders.

Go to Solaxy Presale

5. Decentraland (MANA)

Decentraland (MANA) is a digital actuality platform constructed on the Ethereum blockchain. It permits customers to create, discover, and monetize digital content material. Inside this digital world, customers buy plots of land as NFTs utilizing MANA tokens. The platform operates as a decentralized ecosystem, the place possession and governance relaxation with its contributors via the Decentraland DAO.

Customers can design distinctive experiences, construct interactive environments, and commerce digital property. The platform fosters creativity and self-expression, with progress relying totally on particular person effort and creativeness. The power to personal and promote digital land offers financial alternatives inside the metaverse.

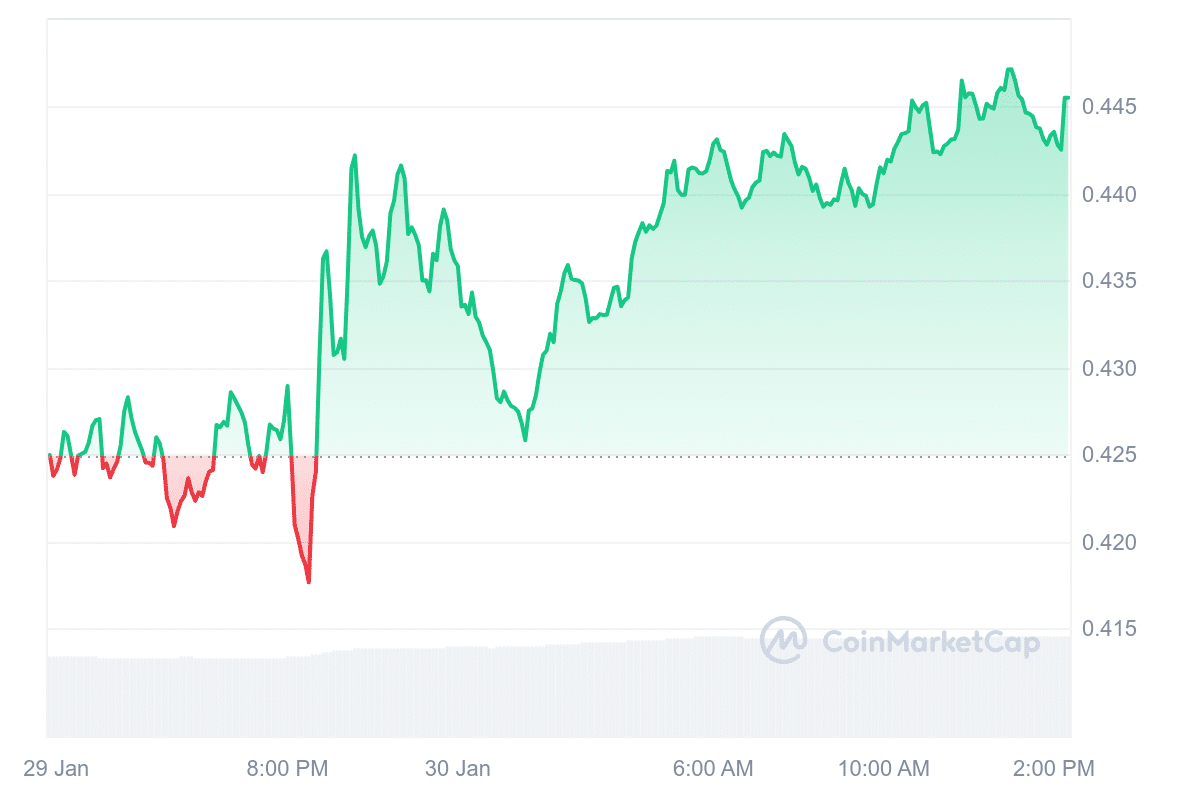

At present, Decentraland’s value is $0.445736, reflecting a 4.82% improve up to now 24 hours. Regardless of this short-term achieve, market sentiment stays bearish. Nevertheless, the Worry & Greed Index stands at 70, indicating a good funding local weather.

2025 is our likelihood to amplify all the pieces that makes Decentraland particular – creativity, collaboration, and connection 🤝

We’re shaping a self-sustaining, vibrant digital world. Let’s push the flywheel ahead collectively! https://t.co/aP3QzPDdWx

— Decentraland (@decentraland) January 23, 2025

The cryptocurrency is buying and selling 0.72% above its 200-day easy transferring common (SMA) of $0.442325, suggesting stability. With an RSI of 47.50, the asset is in a impartial zone, that means it’s neither overbought nor oversold. This might point out sideways motion within the close to time period.

Market evaluation predicts a ten.65% value improve by March, probably reaching $0.488642. Decentraland additionally advantages from excessive liquidity relative to its market cap, making it simpler for merchants to purchase and promote with out important value fluctuations.

Learn Extra

Latest Meme Coin ICO – Wall Road Pepe

- Audited By Coinsult

- Early Entry Presale Spherical

- Personal Buying and selling Alpha For $WEPE Military

- Staking Pool – Excessive Dynamic APY

Be a part of Our Telegram channel to remain updated on breaking information protection