With Wall Avenue trying to repeat a constructive efficiency final 12 months, all eyes are on what shares may have a monumental 12 months. Nevertheless, relating to investments, it’s all the time vital to have one eye strictly fastened on the long run. In terms of that, Amazon (AMZN) and Roku (ROKU) have emerged as shares that would deliver a 400% return on funding (ROI) in 5 years, as specialists look all in.

The 2 firms characterize a number of the leaders in two very completely different areas. Though Amazon has gotten in on the streaming wars lately, it has firmly acknowledged itself as a chief expertise, AI, and cloud computing inventory. Furthermore, Roku seems to proceed establishing market share in what might be an exception run. So, may the businesses skyrocket earlier than 2030?

Additionally Learn: Alphabet Inventory: Why GOOGL is a High NASDAQ Inventory to Purchase Now

Amazon & Roku Emerge as High Shares to Watch Earlier than 2030

In terms of the inventory market, ROI is among the many most vital statistics. Certainly, it showcases the fruitfulness of an funding and the way nicely a particular share did for its traders. But, it’s extremely tough to foretell, with Wall Avenue stuffed with merchants all trying to get in on the most effective deal.

In response to a latest report, Amazon and Roku could also be simply that, as they’re projected to probably produce a 400% return on funding over the following 5 years. For various causes, each firms may emerge as a number of the largest winners when 2030 finally arrives. Particularly, probably turning a $1,000 funding into $5,000.

Additionally Learn: Nvidia, Amazon Lead Magnificent 7 Shares to Watch in January

Of the 2 shares, Amazon is definitely not a shock. The corporate controls 40% of the North American e-commerce realm. Nevertheless, that isn’t its most fun enterprise. Certainly, Amazon Internet Providers (AWS), its cloud computing enterprise, holds immense potential. The enterprise accounts for greater than 60% of its working earnings presently, with development prospects nonetheless sturdy.

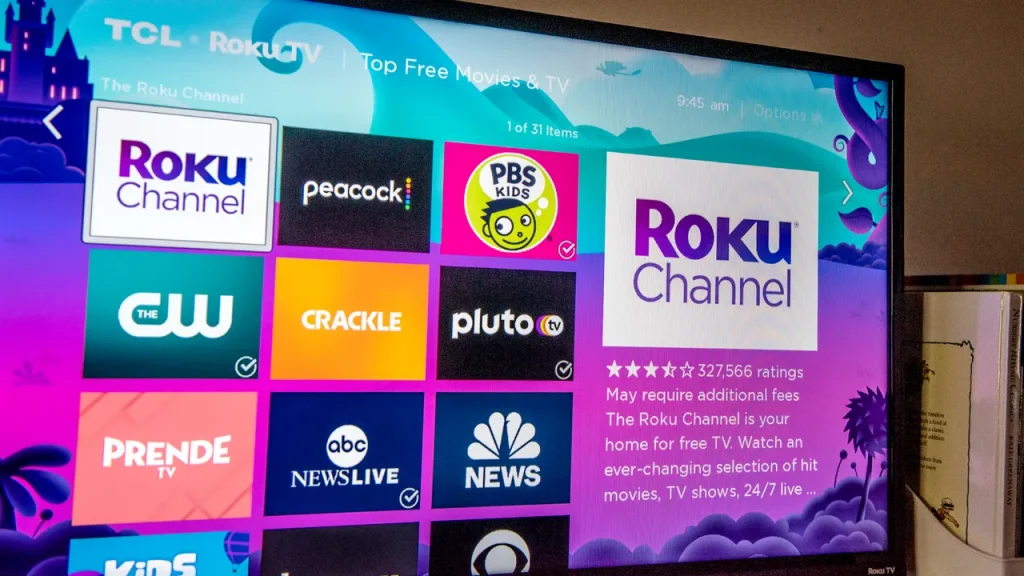

Moreover, Roku has emerged as a key inventory to look at. Shares within the firm skyrocketed in 2020 as a byproduct of the COVID-19 pandemic. That didn’t proceed, sadly. In 2021 and 2022, the inventory fell greater than 80%, boasting a notable lack of profitability.

But they’re nonetheless a dominant firm. In response to Pixalate, Roku controls 37% of North America’s linked tv machine market. Much more fascinating, the closest competitor controls simply 17%. It’s hoping to leverage that success for the worldwide market. That market is projected to develop by 11% annually, which ought to vastly profit its prospects and skill to develop alongside it by 2030.