Bitcoin has been hitting new all-time highs over the previous week because the crypto market recorded sturdy bullish sentiment after GOP candidate Donald Trump gained the U.S. presidential elections.

Bitcoin (BTC) gained 18% over the previous week and is up 3% up to now 24 hours. The main cryptocurrency reached an ATH of $81,858 earlier at present — at the moment buying and selling at $81,000 following a gentle correction.

Because of the constant good points, the BTC market cap surpassed the $1.6 trillion mark. Its each day buying and selling quantity additionally doubled, reaching $92 billion. Bitcoin’s market dominance is hovering at 55.4% on the time of writing.

The so-called digital gold turned the ninth-largest asset because it overtook Meta’s $1.48 trillion market worth.

Bitcoin’s rally triggered bullish sentiment amongst digital asset buyers, pushing the broader market near the 2021 highs. In keeping with information supplied by CoinGecko, the worldwide crypto market cap elevated by 3% over the past day and is sitting above the $2.9 trillion mark.

This stage hasn’t been seen since mid-November 2021.

Information from CoinGecko reveals that the overall crypto buying and selling quantity grew by 80% and is at the moment hovering at $306 billion. This reveals elevated curiosity from market contributors.

Why is Bitcoin rising?

The Bitcoin and market-wide rally began after Trump overtook Vice President Kamala Harris within the U.S. presidential elections because the group known as him the “first pro-crypto U.S. president.”

Trump’s win acted as a significant catalyst for the crypto market, triggering the concern of lacking out, additionally known as FOMO, amongst digital foreign money buyers.

With Bitcoin breaking its March ATH of $73,000, brief liquidations began to extend. In keeping with information from Coinglass, the overall crypto liquidations reached $630 billion up to now 24 hours.

Bitcoin, alone, noticed $121 million in liquidations — $38 million longs and $83 million brief — per Coinglass information. Traditionally, brief liquidations provoke upward momentum and buyers would normally count on excessive volatility.

The elevated buying and selling quantity additionally provides to the market-wide volatility as the costs have been rising together with the election development. Consequently, a possible correction can be anticipated.

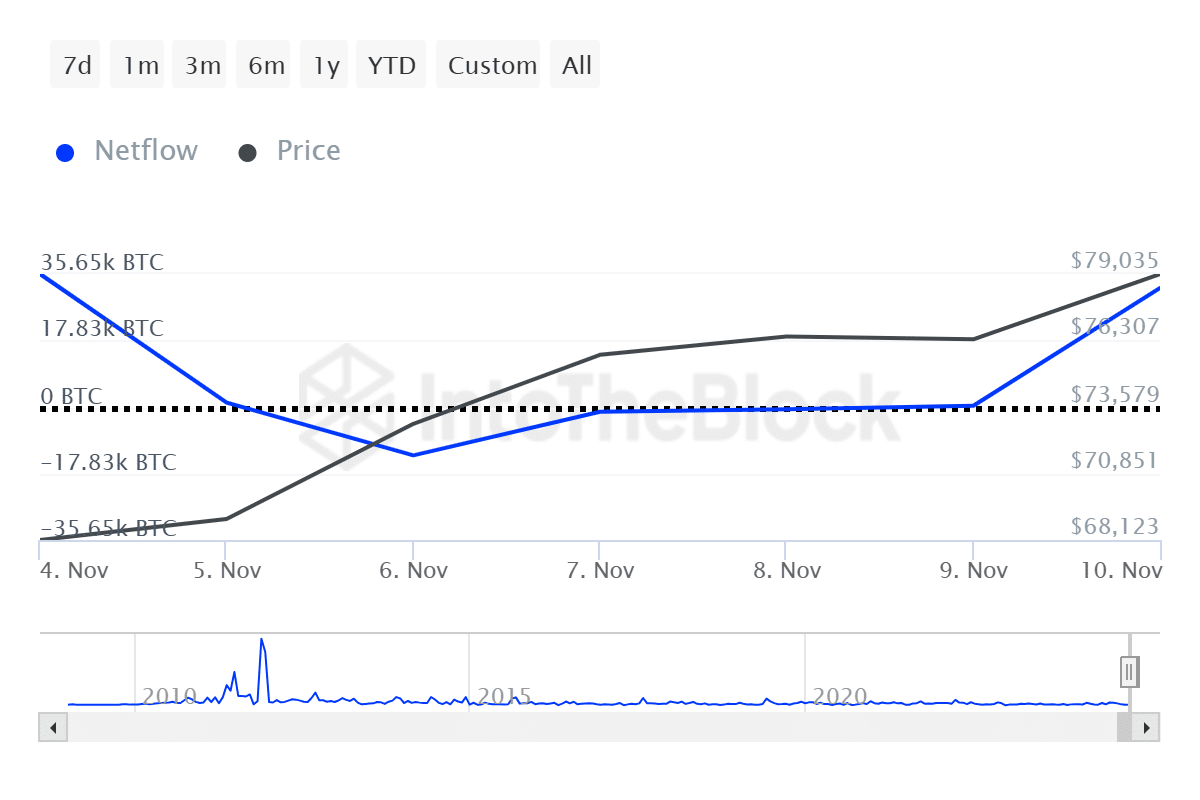

In keeping with information from IntoTheBlock, whales amassed virtually 32,000 BTC on Nov. 10. Because the chart reveals, the massive holder exercise has been shifting in the identical route because the BTC value since Nov. 6, the election day.

The sudden surge in Bitcoin’s whale accumulation additionally suggests FOMO amongst market contributors.