Whereas the title of this perception could seem overly bullish, it’s merely a truth based mostly on the information. Nevertheless, historic patterns don’t actually line up with such a bullish state of affairs. Throughout every Bitcoin cycle, the worth improve has been round 27% of the final interval. Ought to Bitcoin proceed this pattern, we should have trigger for optimism, albeit not with satoshi/greenback parity fairly but.

The worth improve for every halving cycle seems to decrease considerably over time.

- First Halving (to Second Halving): 10,300% improve

- Second Halving (to Third Halving): 2,800% improve

- Third Halving (to Fourth Halving): 738% improve

Every cycle reveals a considerable discount within the proportion improve. To forecast a pattern, let’s analyze the approximate price of lower:

- From Halving 1 to Halving 2:

(2800 / 10300) ≈ 27.18%of the earlier improve. - From Halving 2 to Halving 3:

(738 / 2800) ≈ 26.36%of the earlier improve.

If we proceed this diminishing price, Halving 4 may see a rise of round 26-27% of the earlier Halving’s proportion improve:

738 * 0.265 ≈ 195.57%

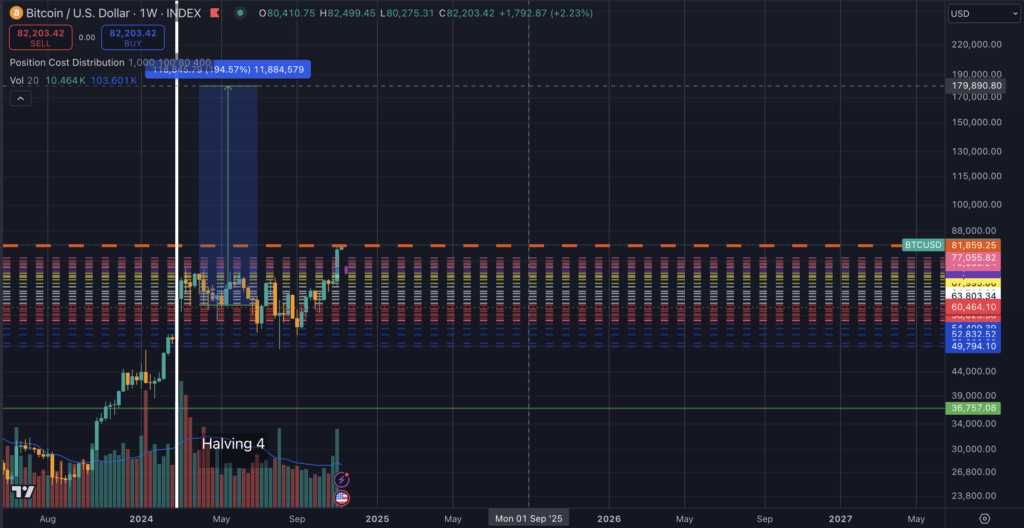

Estimate for Halving 4: We might estimate a rise of roughly 195% over the halving worth. This follows the pattern of diminishing returns per cycle.

Such a worth improve would take Bitcoin to a peak of round $180,000 this cycle.

For enjoyable, if Bitcoin had been to interrupt the diminishing returns sample and improve by 50% or 100% of the final cycle’s improve, we might see costs of $304,000 and $520,000, respectively.

Ought to Bitcoin one way or the other discover the vigor of the 2017 bull run, it could rise as excessive as $1.8 million per coin.

Keep in mind, previous efficiency shouldn’t be a assure of future returns. Bitcoin remains to be in its infancy as an asset, and something might occur subsequent.

Besides, for my part, going to zero.