Ethereum continues to be struggling to achieve its March excessive of $4,000, not to mention the all-time excessive of $4,891 in November 2021.

Ethereum’s (ETH) on-chain actions together with its decentralized finance sector have remained robust whereas the main altcoin is seeing excessive value volatility amid market turbulence.

ETH briefly touched a four-month excessive of $3,444 on Tuesday, Nov. 12. Following the worth drop from its native excessive, the king altcoin has been consolidating between $3,120 and $3,290 over the past two days.

Whereas Ethereum continues to be down by 34% from its ATH, its fundamentals stay robust.

ETF inflows

Spot ETH exchange-traded funds within the U.S. have been registering consecutive inflows for the reason that U.S. elections final week.

The funding merchandise began the week with a document web influx of $295.5 million led by Constancy’s FETH and BlackRock’s ETHA funds — value $115.5 million and $101.1 million, respectively.

On Wednesday, spot ETH ETFs had a web influx of $146.9 million, taking the entire inflows to $241.7 million.

That is the primary time these ETH-based funding merchandise have seen robust demand since their launch in July.

Whale accumulation

Ethereum can also be seeing elevated whale accumulation because the market individuals wander in grasping circumstances.

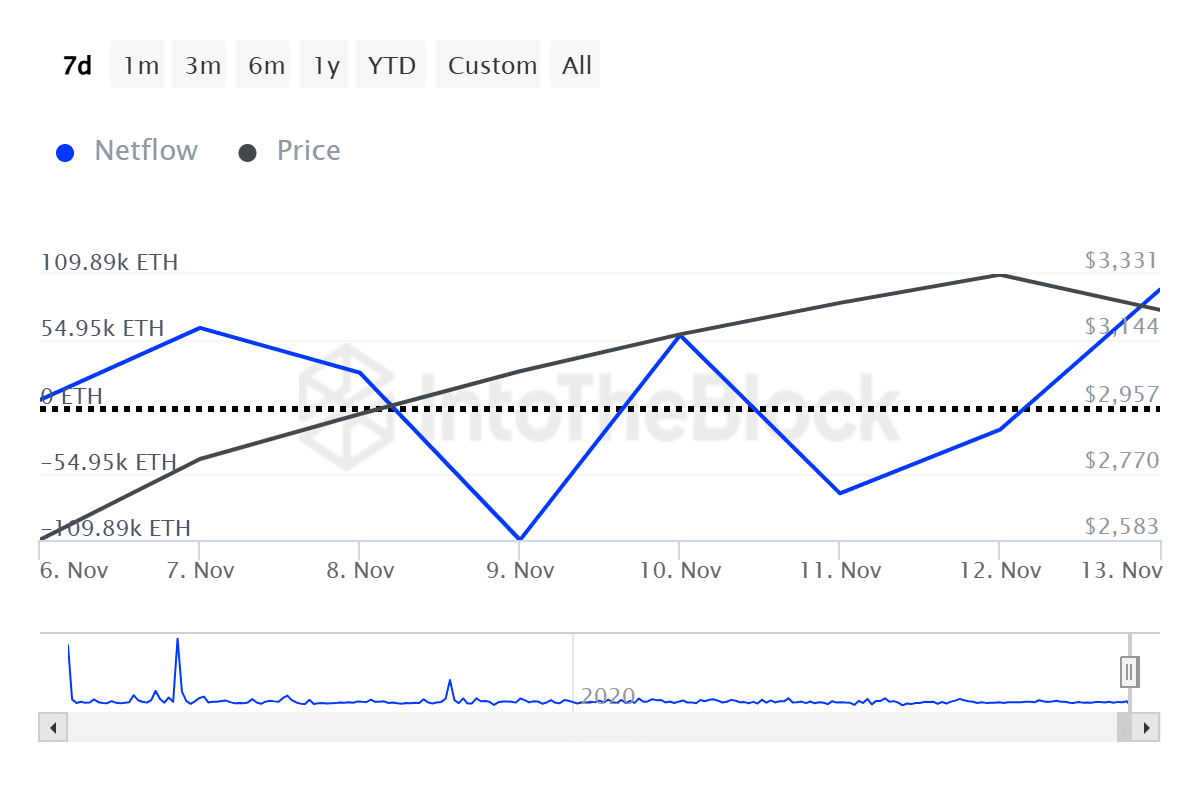

Massive holders noticed a web influx of over 97,000 ETH, value roughly $310 million, yesterday, in line with knowledge offered by IntoTheBlock.

Whale accumulation usually triggers the concern of lacking out amongst retail traders. This normally results in excessive value volatility earlier than gaining regular upward momentum.

Alternate outflows

Along with whales, retail traders have additionally been busy accumulating Ethereum.

ETH recorded an alternate web outflow of $1.12 billion over the previous week, knowledge from ITB exhibits. The big holder-to-exchange web move ratio suggests robust retail accumulation on Nov. 9, 11 and 12.

Alternate outflows normally result in long-term holding which might finally pave the way in which to a gradual development.

DeFi development

Ethereum’s DeFi sector has additionally been surging.

The full worth locked in Ethereum-based protocols elevated by roughly $10 billion after the crypto market gained bullish momentum on Donald Trump’s win within the U.S. presidential election, in line with knowledge offered by Defi Llama.

Furthermore, the entire charges collected by DeFi platforms on the Ethereum community tripled over the previous seven days to $18 million. These protocols generated a complete income of $15.5 million over the previous day.

Hitting $4k earlier than 2025?

Amberdata, a market evaluation agency, claims that there’s an 18% likelihood of Ethereum reaching the $4,000 mark by the top of the yr.

“We’re nonetheless a good distance from ETH’s all-time excessive. Which makes us assume we might have some room to run.”

Amberdata wrote in an X publish.

The robust development in ETH ETFs and the rising whale accumulation might add to the optimistic Ethereum value momentum.

Nevertheless, it’s vital to notice that macro occasions might probably shift the market’s focus to the opposite manner regardless of bullish on-chain indicators.