On this planet of investing, the age-old adage “The pattern is your pal” is as related as ever. Recognizing a robust pattern and understanding the way to capitalize on it may be the distinction between sitting on the sidelines and making significant good points. Whereas I firmly consider that BSV will in the end take the lead as essentially the most vital blockchain on this planet, BTC’s market dominance is flashing bullish alerts proper now, and that shouldn’t be ignored for the remainder of the yr.

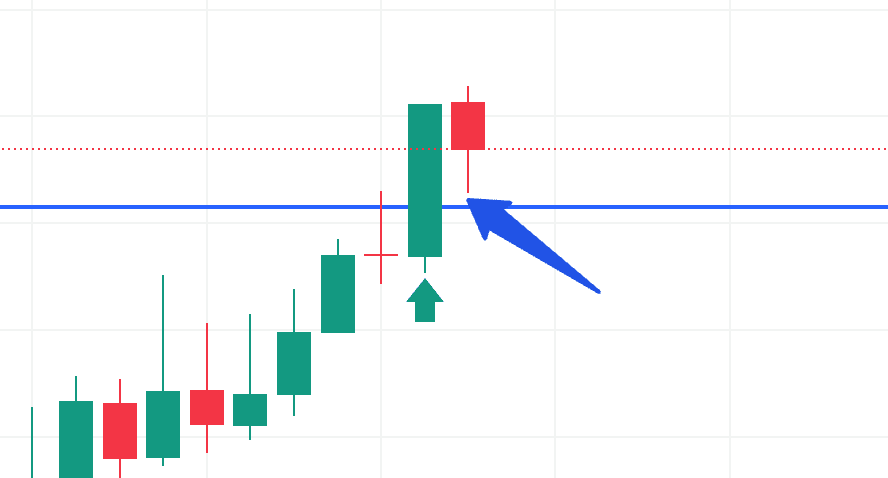

BTC is displaying a basic “Breakout, Retest” sample, a dependable indicator of potential development, and all indicators recommend that it might outperform different belongings within the brief time period.

For these unfamiliar, right here’s a short breakdown: a long-term pattern line represents psychological resistance when BTC trades under it, marking the place market sentiment prevents it from climbing increased. BTC/USD has been trending under this line since early 2021, with upward momentum constructing during the last 18 months.

Lastly, BTC has damaged by way of this resistance line, signaling a bullish reversal that would lead to months of optimistic motion. If BTC holds above this line, it might sign a shift in liquidity flowing into BTC from different blockchain belongings.

A significant catalyst behind this transfer is Donald Trump’s return to the White Home. As polarizing as his earlier administration was, his re-election might deliver insurance policies prone to help American industries and vitality manufacturing—a good setting for BTC miners. Trump’s deal with vitality independence, deregulation, and incentivizing home manufacturing positions BTC miners nicely. There’s additionally the truth that he has overtly come out to state that he can be a “crypto pleasant” President and particularly block the creation of an American central financial institution digital foreign money (CBDC), so the notion that his administration might favor the U.S. blockchain sector, notably mining, has fueled optimism out there, creating what could also be a short however vital alternative for these seeking to make portfolio changes. For these inclined towards portfolio administration over ideology, taking a place in BTC might enable them to seize a few of this momentum.

But, regardless of the bullish potential, there are grounds for cautious optimism. Trump’s historical past with regulation and lack of sophistication within the blockchain trade could deliver unintended penalties, as he might inadvertently bolster a few of the much less respected elements of the financial system—just like the fixed pumper Charles Hoskinson.

My reservations lie right here: Trump’s enthusiasm could amplify the hype round “crypto” on the expense of substantive blockchain improvement, reinforcing the extra speculative—and sometimes fraudulent—underbelly of the trade. Whereas BTC’s rally could enchantment to buyers’ need for fast returns, the dearth of nuance in Trump’s strategy might inadvertently feed the volatility and exploitative techniques that plague these elements of this ecosystem.

Nonetheless, for these cautious of betting on BTC, Trump’s re-election might spark development in a number of different sectors for the savvy investor to think about:

– Vitality and Fossil Fuels: The U.S. has been advancing towards vitality independence for over a decade, with home petroleum merchandise now being web exported globally. Trump’s insurance policies might amplify U.S. oil and fuel manufacturing, making conventional vitality shares enticing. His potential rollback of inexperienced vitality mandates may also redirect funding flows towards conventional vitality, affecting the valuations of shares targeted on renewables. Conventional vitality producers could profit as rules ease and manufacturing ramps up.

– Protection and Safety: With Trump’s emphasis on bolstering the navy and securing borders, protection contractors could discover new alternatives. Trump has peace-makers rhetoric internationally, seeing a possible finish to globalist militarism, however cybersecurity corporations, particularly these concerned in safeguarding vital data networks, are prone to profit as “wars” more and more shift the protection finances from ammunition to data on the digital battlefield. Firms inside this sector might even see substantial authorities contracts beneath a second Trump time period.

– Manufacturing and Industrials: Trump’s deal with American manufacturing and import tariffs might enhance home manufacturing. Industries starting from metal to building may benefit as insurance policies encourage localized manufacturing. This pattern may additionally prolong additional deeply to medical tools manufacturing, because the getting old American inhabitants will increase demand for domestically produced medical provides and know-how.

– Agriculture: Trump’s historic help for rural America and agricultural subsidies could result in a good setting for American farmers. He might incentivize agribusinesses by way of subsidies or tariffs on imported meals, successfully bolstering home agriculture. States like Ohio and Pennsylvania, instrumental in Trump’s previous victories, may additionally obtain additional help, and with an eye fixed on 2028, he might be grooming allies like J.D. Vance for future management, making agriculture a strategic focus.

That is in distinction to what may be tough years on the horizon for large pharma and their allies within the authorities as Robert Kennedy Jr. targets them for justice round numerous malfeasances during the last couple of a long time, so sensible cash may be shifting away from a few of the finest investments of the Biden administration.

Whereas BSV’s potential stays the inspiration of my outlook on blockchain, there are at all times alternatives to think about alongside the best way. The power to acknowledge and strategically experience a pattern—particularly when it aligns with broader financial and political shifts—generally is a highly effective instrument for constructing wealth. A pattern that can be beginning to materialize significantly is the pattern towards the recognition of impartial political energy—as this election clearly reveals.

Political and cultural pattern

And that’s one other facet of all of this that I actually suppose is price contemplating deeply. There’s a new and inspiring macro pattern within the tradition.

Donald Trump’s political trajectory has been as maverick as they arrive, a indisputable fact that continues to affect his enchantment. Trump was as soon as a registered Democrat and a longtime ally to New York politics and households just like the Clintons. His historical past mirrors these of a lot of his notable allies and backers: a robust enterprise focus and a dedication to the American employee. In contrast to the standard partisan playbook, Trump’s insurance policies and rhetoric have drawn a big populist coalition of disillusioned Democrats, moderates, and former liberals who’ve grown pissed off with what they see as an more and more ideologically pushed and divisive panorama on the left. This even crept into conventional minority communities who voted for Obama and Biden, however really feel just like the Democratic occasion has deserted the center class in favor of Hollywood and fringe social politics.

Figures like Elon Musk, Tulsi Gabbard, Robert F. Kennedy Jr., and even semi-outside allies like Joe Rogan are both straight aligned with Trump’s views or have discovered widespread floor together with his emphasis on financial pragmatism, classical patriotism, and disdain for the “woke” tradition that dominates mainstream Democratic politics at present whereas nonetheless seeing themselves basically as Democrats or liberals at their core.

Every of those figures as soon as belonged to or aligned with the Democratic Social gathering but discovered themselves pushed out as their deal with sensible points like job creation, financial self-sufficiency, and freedom of speech turned politically untenable of their former circles. Elon Musk, previously a proponent of unpolluted vitality and tech-forward liberal insurance policies, is now a vocal critic of identification politics, aligning extra intently with libertarian and conservative values round enterprise freedom and free speech. He’s additionally aligning himself with the basic maverick Republican Ron Paul to run “DOGE,” the Division of Authorities Effectivity.

Tulsi Gabbard, a former Democratic congresswoman and presidential candidate, left the occasion to deal with navy reform, safety of particular person liberties, and a non-interventionist international coverage—points she argues now not have a spot within the trendy Democratic platform. Robert F. Kennedy Jr., a widely known pro-environmental and anti-corporatism advocate, has pivoted towards defending American freedoms towards governmental overreach and the deep corporatism that has come on the backs of Democratic Social gathering administrations, a place that has now made him a darling with unconventional, populist conservatives.

On an much more shocking word, we’re even seeing health-conscious insurance policies—a cornerstone difficulty of the populist left since at the very least the 1960’s—turn out to be a key right-wing difficulty as conventional conservatives embrace wholesome consuming and dwelling as a core worth. And the bizarre half is that liberals are actually rejecting well being attributable to its affiliation with right-wing crimson flags!

In some ways, Trump’s upcoming administration seems prepared to steer a coalition that’s as untraditional as he’s. This unorthodox crew’s enchantment lies not within the conventional left-right spectrum however of their shared mission to chop by way of political ideology and deal with insurance policies which have tangible results on the lives of working Individuals. They’re not afraid to ruffle feathers in both occasion, which resonates in an period the place the citizens is deeply pissed off with the institution. For the blockchain world, this new-school vitality interprets to a extra favorable regulatory setting, notably if insurance policies are formed with a hands-off, business-friendly strategy, which can be a web good for the trade.

Whereas Trump’s deeply unconventional type comes with dangers—together with his usually unpredictable stance on regulation and the potential for bolstering the extra speculative aspect of crypto—this new political local weather presents a novel second for growth-oriented sectors like mining, conventional vitality, and blockchain. Every of those industries stands to learn if Trump’s administration carries ahead a pro-business, anti-regulation stance.

With all of this in thoughts, a savvy investor will regulate the sectors that stand to learn from Trump’s neo-traditional coalition, from BTC mining to fossil fuels, manufacturing, free speech media, and past. It may be season to observe the pattern of entrepreneurship, well being, private empowerment, onerous work, and, in some instances, simply being a mean American with none hyphens or reservations. Staying attuned to those developments might be the important thing to navigating the following 4 years of American politics with confidence and profitability.

On a private word, there’s a actual alternative right here to ingratiate the brand new administration to the ability of managing actual belongings on a very scalable blockchain. As an alternative of merely criticizing Charles Hoskinson or Trump’s DeFi undertaking, I want to formally supply to clarify Teranode, overlay networks, real-world belongings, and the ability of the Metanet idea for making the world a very higher place for commerce and free folks world wide.

In case you have a connection, hook me up!

Watch: Teranode is the digital spine of Bitcoin

title=”YouTube video participant” frameborder=”0″ enable=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>